A payroll system is a set of procedures used to streamline and manage employee payments. It ensures that employees receive their earnings in a systematic and organized manner. Nowadays, payroll systems have been transformed into software programs that can help users to complete the required processes more quickly and efficiently.

Why Should Small Businesses Invest in Payroll Software?

The payroll process feels like one of the biggest bottlenecks in running a business as it takes days to complete the entire process.

And for small and medium-sized enterprises (SMEs), the challenge isn’t just the time and energy needed to run through the process. Compliance around CPF calculations, SDL, Self-help group contributions, exporting data for follow up action such as bank runs and submitting information for tax filings all add up to create regulatory complexities to navigate. Business owners need to be up to date on all of these to avoid being non-compliant.

[Blog] How to Calculate Incomplete Daily Salary and Monthly Salary

Besides, if a business is running in multiple locations or outlets, then ensuring a standard payroll process with respect to the local and regional compliance bodies becomes another challenge. Imagine how much time SME businesses have to allocate to complete the payroll process if done manually.

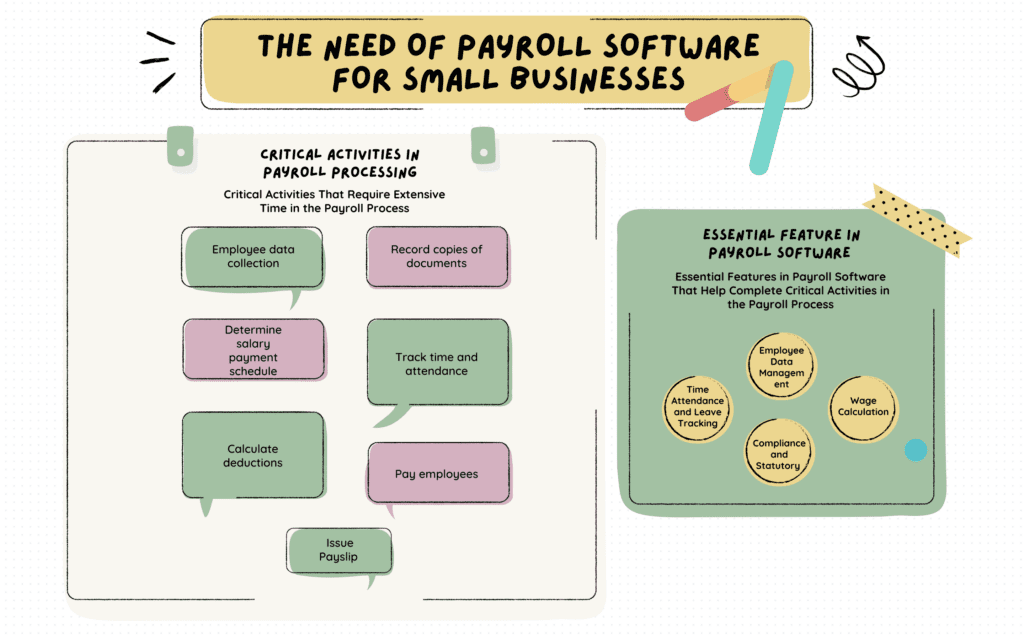

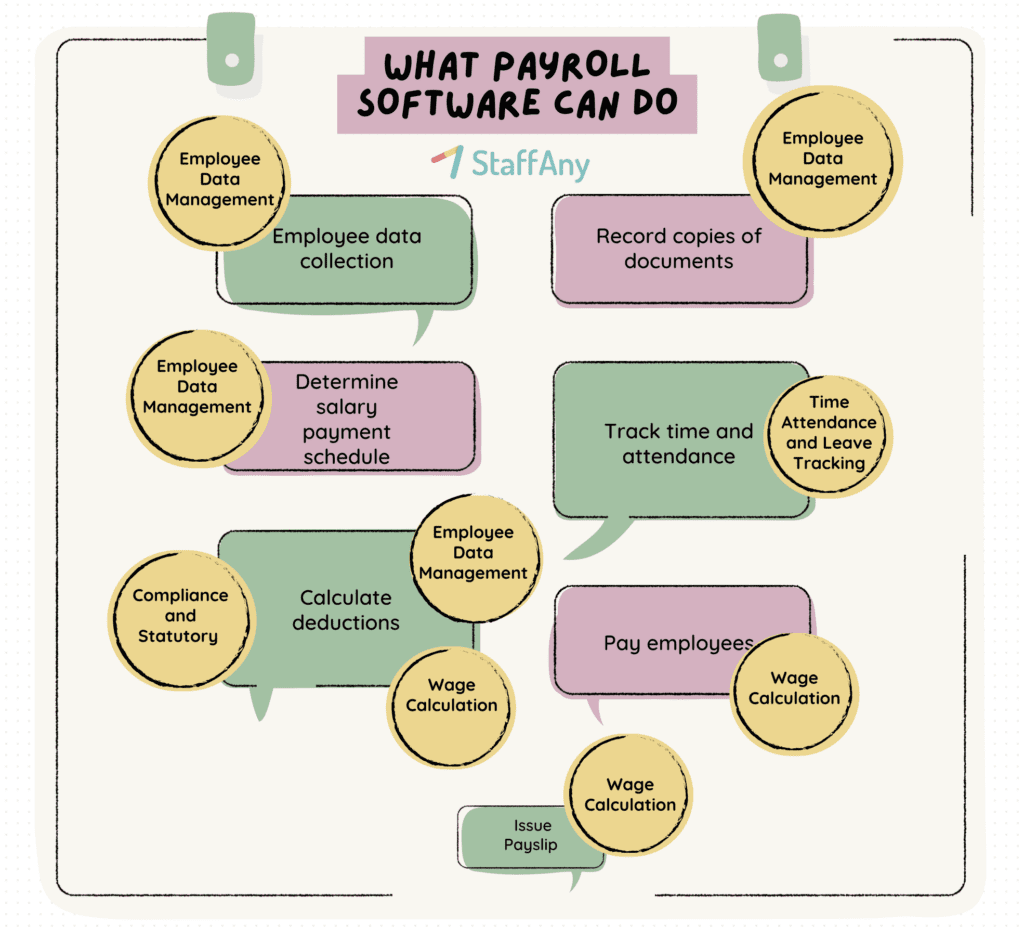

Generally, businesses dedicate numerous hours each week to handle payroll processing, the duration of which varies based on the methods and tools employed. If you break it, that time-consuming payroll process needs to go through the following critical activities.

- Employee data collection

Collecting information about employees is really important, especially in Singapore. That’s because there are specific deductions from funds (like CPF, SHG, SDL) based on things like a person’s race, religion, and the groups they’re part of in society. When businesses gather accurate data about these details from their employees, it helps make sure that the deductions are fair and in line with the diverse backgrounds of the workforce.

- Record copies of documents

Accurate record-keeping is crucial to ensure that employees receive correct pay and that the business remains compliant with regulations. Hence, you need to have organized paper files to store physical copies of employee documents.

- Determine salary payment schedule

Once you’ve got the correct employee info, decide how often you want to pay your team, it could be twice a month, or once a month. Whatever you pick, make sure your employees know when payday is. And, you need to understand that how often you pay will affect how long it takes to process your paycheck. For example, if you pay every two weeks, it will take a little longer as there is more paperwork to track the time compared to a monthly paycheck.

- Track time and attendance

Managing payroll and keeping track of time are closely connected. The hours they work decide how much they get paid. So, it’s necessary to have a good system to record their hours accurately. Also, don’t forget to track things like lunch breaks and time off to make sure everyone gets paid right.

- Calculate pay items and deductions

Now that you’re monitoring work hours, the next step in payroll is calculating deductions. Begin by determining the pre-deduction earnings. Then, consider specific deductions, such as CPF-able ones, excluding taxes.

- Pay employees

You should now know how much your employees take home after the deduction calculation, and it’s time to do payroll. Whether they like getting paid through direct deposit, paycards, or printed checks, it’s important to make sure they get the right amount on time. If you do payroll by hand, remember that public holidays can delay direct deposit payments, so keep that in mind when processing pay.

- Issue payslip

According to the Ministry of Manpower Singapore, all employers must issue itemized payslip to employees covered by the Employment Act. This itemized payslip must be provided in soft copy and hard copy to each employee. Please see the requirement information on the MoM site here.

Long story short, whether you’re just starting out or running a small chain or outlets, it’s important to have a good payroll system. Moreover, you will go through a number of lengthy processes as described above to make payroll a success.

However, hiring people to handle payroll in-house can be expensive, especially for smaller businesses with only a few employees. Hence, many SME businesses in Singapore use payroll software to assist them in completing the payroll process.

Essential Features You Need to Look for in a Reliable Payroll Software

As the backbone of an organization’s compensation process, a capable payroll software should have a number of important elements. What are the important features of payroll software for Singapore companies to look out for? Check the list below.

- Employee Data Management

The essence of a payroll software lies in accurately managing employee information, encompassing personal details, employment contracts, tax, and bank information. Effective data management ensures precise payroll calculations and streamlined communication with employees.

- Time Attendance and Leave Tracking

Accurately compensating employees relies on tracking work hours. The time and attendance component in a payroll system entails recording employee attendance, breaks, leave, and overtime hours. It can be accomplished through manual timesheets, time clocks, or online payroll system solutions. This precise tracking mitigates discrepancies and ensures fair payment for employees.

- Wage Calculation

In restaurants and cafes, making sure staff get paid right is super important. A good payroll software adds up things like regular pay, hourly wages, bonuses, and more, while also taking out stuff like taxes and benefits. Using set rules, this payroll software does the math for you, making sure everyone gets the correct pay without mistakes and saving time.

A good payroll software can help you count shift-based customized pay item components such as regular salary, prorated salary for an incomplete month, weekend shift/event, and over-time allowance. With the ease of calculating these customized pay items, you no longer need to worry about the accuracy of the salary portion of each employee.

[Download] Free Singapore Payslip Template with CPF Calculation

- Compliance and Statutory

Ensuring compliance with legal and regulatory standards is a crucial aspect of effective payroll software. It needs to be aligned with labor laws, regulations, and data protection laws, incorporating security measures to protect sensitive employee information and prevent unauthorized access. Adherence to these regulations not only shields the organization from legal consequences but also fosters trust with employees.

Who Are The Leading Providers Of Payroll Software For Small Businesses?

After learning what criteria to look at in determining a reliable payroll software, you may ask who are the leading providers of payroll systems for small businesses? PayrollAny from StaffAny is one of the payroll software that supports small business operations, especially startups that focus on the F&B industry.

Payroll software shouldn’t add more time to tasks like balancing leave and additional working hours or benefits management and sync those components into payslip. Say goodbye to silos and manual data pulling! PayrollAny is built directly on top of scheduling and timesheet systems. You will also no longer have problems converting timesheets into payslips because PayrollAny only requires three easy steps to convert timesheet calculations into payslip details.

And if you’ve been struggling with compliance and tax processes, PayrollAny also has automated calculation features for various payroll deductions based on Singapore government laws. Currently, PayrollAny can accurately calculate CPF, SDL and SHG for each employee for each company payroll cycle.

StaffAny also observed that there are at least 6 other payroll software companies that are suitable for SMEs in Singapore. You can learn the full list along with their key features through this article link.

In summary, using a payroll software like PayrollAny ensures accurate and timely payment of salaries, helps with tax calculations and compliance, and contributes to overall cost savings. Small businesses can then focus more on growth and less on administrative tasks.

For more in-depth details, please check our PayrollAny page.