A glimpse into the future for F&Bs: Re-opening in Overseas Markets

And at last, we see the light! Singaporeans have been basking in greater freedom also known as Phase 2. Nonetheless, its sudden announcement was met with a frenzy of activity for F&Bs preparing for re-opening on 19th June.

For Wok the Talk’s 3rd episode, international edition, we had the privilege of having Kevin Chung – Director of Morganfield’s Singapore, Renyi Chin – Co-Founder of myBurgerLab Malaysia as well as Kulawachara (Paul) – CEO of ChouNan Co., Ltd Thailand. Our panel, composed of key F&B leaders across South East Asia, gave us insights on what re-opening looks like for them. Key topics include:

- What lockdown has been like for the different countries within SEA

- Some business shifts made when lockdown first started

- Key considerations when planning for the post-lockdown re-opening

How’re you doing, neighbour?

With Singapore heading for re-opening soon, we did a quick check in with our neighbours. Renyi gave some context about Malaysia’s current situation in the recovery phase, meaning that almost all industries are allowed to open. Gyms, barbers, F&Bs, etc are allowed to operate as long as they follow Standard of Procedures (SOPs) put in place by the government. For F&Bs, tables have to be 2ft apart and patrons sitting together have to be 1ft apart. Because of such regulations, 50 seater restaurant spaces now hold a mere 25 seats. Renyi warns that with this in mind, the re-opening decision for outlets and restaurants should be deeply considered as it may not be economically viable.

As for Thailand, Paul shared that retail stores are open and people can go out. However, face shields and masks are a must. For restaurants, groups can sit at the same table but table shields have to be erected to separate people and have them sit 1 by 1 – essentially creating a one-person cubicle within the table. Just like Singapore, there is a mandatory scanning of QR codes before entering so that citizens can be identified for contact tracing purposes.

Consumer habits have changed and so must F&Bs

The reality of the global situation is that, throughout the lockdown period, takeaways and deliveries are the only viable option. During the period where consumers were forced to stay home, F&Bs had to adapt to the changing habits and demands of consumers.

For Kevin, he identified that many Singaporeans have taken to experimenting in their kitchens as a new hobby during the Circuit Breaker. As Morganfield’s had previously done Christmas set takeaways, he decided to incorporate that idea during the CB period as well. With everyone’s newfound culinary interest, Morganfield’s created meal kits that allowed customers to try cooking. This meant that they were able to target a new consumer pool and engage with customers that they weren’t able to before. Though the cost of packaging was on the higher end, the idea of the meal kits were validated especially during the Mothers’ Day weekend, so they continued building on that. On top of the meal kits, Morganfield’s also diversified by creating a new brand that served $10 rice bowls. They launched it on third party delivery platforms and are currently looking to expand this.

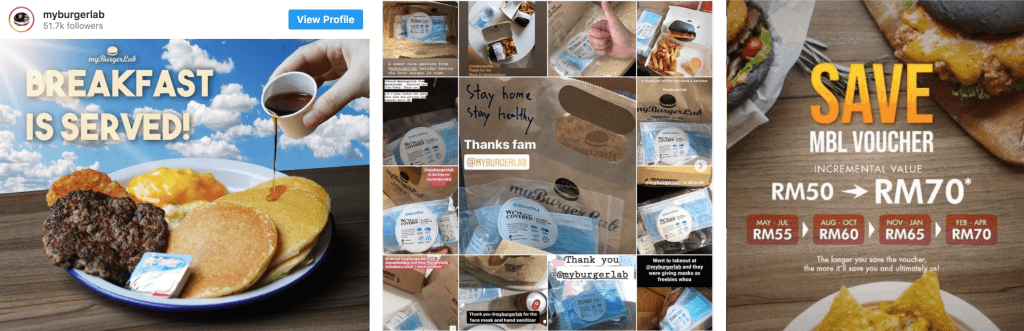

Much like Singapore, lockdown for our neighbours also meant that dining in at restaurants were curtailed. For Renyi, he shared that what worked for myBurgerLab in Malaysia was to show that as a brand, the focus was not just on burgers but the people and the community at large. They shared good hygiene practices on their social media platforms and even co-sponsored masks and sanitizers by partnering with Grab and Coway. This reinforced myBurgerLab as a brand that prizes the people.

In April, when myBurgerLab needed cash flow to tide through, they launched a Save MBL incremental voucher which consumers could buy at RM55. In the next month, it will be worth RM60 and the following month, RM70. This was strategically executed to minimize consumers from rushing out the moment the lockdown ended. It is believed that because the brand had placed people first and this gesture was felt by their customers, they were more than willing to come to myBurgerLab’s aid and help them raise RM50,000 in less than 12 hours.

Furthermore, due to government regulations where restaurants aren’t allowed to operate past 8pm, myBurgerLab decided that since they could not open till late – they would open early. Sticking to what they did well, they partnered with neighbouring restaurants to create breakfast sets. Pancakes from their partners and patty, scrambled eggs and hashbrowns from myBurgerLab. They validated the idea of breakfast sets from McDonalds and indeed, sales were boosted during MCO.

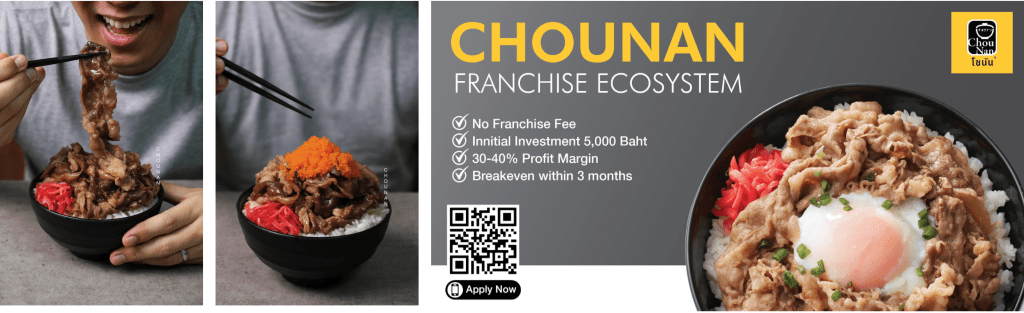

In Thailand, Paul shared that ChouNan’s sales revenue plunged to zero when Thailand first entered lockdown. ChouNan simply had to quickly innovate to generate revenue and took to FaceBook Live to sell their raw materials to customers. However, they needed a longer term business model that no longer relied heavily on shopping malls. Hence, the idea of the ChouNan Franchise Ecosystem was born.

With the need to expand operations outside of malls without incurring the costs of opening a new restaurant and hiring manpower, franchising could help, especially by tapping on the existing kitchen facilities of their partners. Their key partners include hotels, who were also facing huge revenue declines during that period, existing restaurants and homebased cooks that could use the extra revenue. By expanding their reach to more locations, it also reduces the logistics costs of delivery as delivery platforms charge less for deliveries within a 2km radius. This ghost kitchen concept also benefits consumers as they get their food delivered fast, which means their food will still be warm, and prices are not inflated as cost of delivery remains low.

Consumer habits – Is change the only constant?

With Singapore’s sudden announcement of Phase 2, it was the elephant in the room for all our F&B friends wanting to know how to prepare for consumer trends in the new normal.

Kevin shares his gratitude towards the Singapore government for their support in the form of rental waivers to tackle this uncertainty. In the last two months, Morganfield’s has made many manpower adjustments such as letting go front of house staff and doubling down on the back of house staff for takeaways. They even applied for business loans which helped them tide through this period. However, much like most Singapore-based F&Bs, the biggest uncertainty is how consumers will react come phase 2. Kevin predicts a 50-50 situation where some will want to go out whereas others would choose to play safe. All in all, he sees the transition to takeaways and delivery as a mainstay in the coming 6 months.

Paul reaffirms this based on trends in Thailand – though it has been almost a month since Thailand’s re-opening, many consumers still remain cautious. Sales are only at 30%-50% of pre-COVID days, especially with the limited seating capacity. However, he is hopeful that the Thai government will increase efforts to boost trust in consumers and encourage them to go out and dine.

Paul also foresees a tremendous change as people get used to e-commerce and online payments as a way to go. For traditional industries that relied heavily on brick and mortar stores in the past, they will have to go online. Recently, Thailand saw the launch of a new delivery platform. Based on such initiatives and market trends, Paul sees that the delivery sector will be a competitive yet lucrative space where more local players will venture into and provide lower service/delivery fees, hence pushing consumers towards delivery as the main option.

As for Renyi, he assured F&B owners that name brands would definitely see a swarming crowd once re-opening begins. Especially for dining places that rely on the experience it gives consumers, such as KBBQ and Hotpot, these places saw a spike in business when Malaysia’s MCO was lifted.

A word of advice Renyi shared, was that as an F&B community, everyone should remain united. As business owners, many might think of ways to accommodate as many customers as possible to recoup losses. However, Renyi reminds businesses of their sense of social responsibility. Trying to accommodate greater crowds may put risk on hygiene and safety.

He shared that myBurgerLab currently operates only to breakeven. As most of their revenue goes to third party delivery platforms, they just want to continue paying their staff and keep afloat during this period. On the flipside, market sentiments are also driven by the actions F&Bs take. If restaurants don’t open past 8pm, people tend to not want to be outside after 8pm. In Malaysia, some malls are starting to impose penalties on F&B outlets who close before the closing time of the mall they’re located in. This is so as to attract and retain consumers during this lull period.

A penny for your thoughts: alternate revenue streams

Since COVID hit, F&B owners have been seeking alternative ways to diversify and adapt to the ever changing situation, even into re-opening. Right now, we do see a segment of the new market that enjoys cooking. However, do they always want to start from scratch?

Before our panel parted, Renyi shared his 50-90-99 theory on home kits. Familiar examples of this would include DIY bubble tea pearls sold by bubble tea brands. For home kits, understanding consumers’ experiences can allow businesses to better understand which percentage level of “doneness” is optimal. For instance, if the item is difficult for consumers to nail at 50% doneness, 90% may be better. At Renyi’s other restaurant, myPizzaLab, pizza kits contain pre-rolled dough. However, consumers still have the room to interact with the dish by putting their own favourite ingredients before popping it into the oven. Renyi shared that 90% has been the most profitable level and it also works for customers by creating the “IKEA effect”. This is what happens when consumers place a disproportionately high value on products they partially created due to that sense of accomplishment.

Collaboration was another strong suggestion offered by our panel. In Singapore, Kevin notes that for the beverage industry, collaboration with food outlets has helped them to weather this storm. Especially when the government disallowed F&Bs that only sold beverages to continue operations. While many collaborations feature a “my finished product plus your finished product” approach, Renyi shared a creative way of collaboration that increases brand presence. myBurgerLab partnered with other restaurants by offering their patties or sauces and incorporating them into their own dishes. In return, these partners would feature an “in collaboration with myBurgerLab” tagline on the menu. This gives myBurgerLab increased brand awareness without overt marketing costs.

What Next?

A clear thread through our webinar discussion was the proactivity of these F&Bs towards recovery and re-opening. Whether it was exploring new concepts, business models, product lines or even asking for help in creative ways – they possessed a bold and innovative spirit. With these, we hope that F&B owners are inspired to take action aligned with their brand, even if it may be unconventional or risky.

P.S. You know the drill – keep your eyes peeled for Wok the Talk episode 4, happening mid-July! 🙂

Leave your details below to get first dips on it!